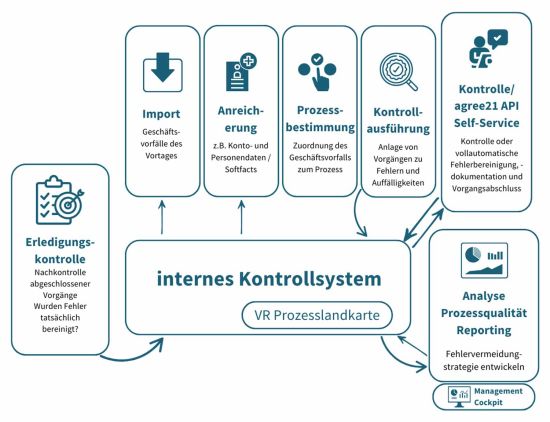

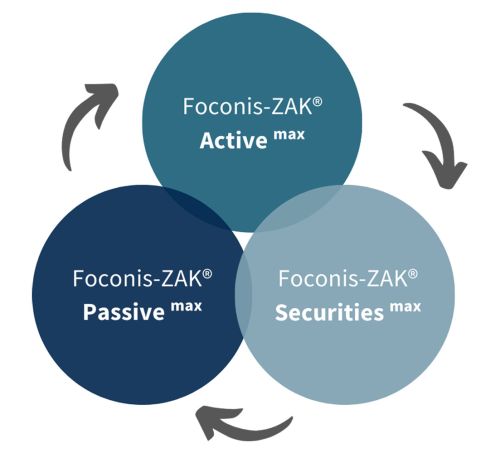

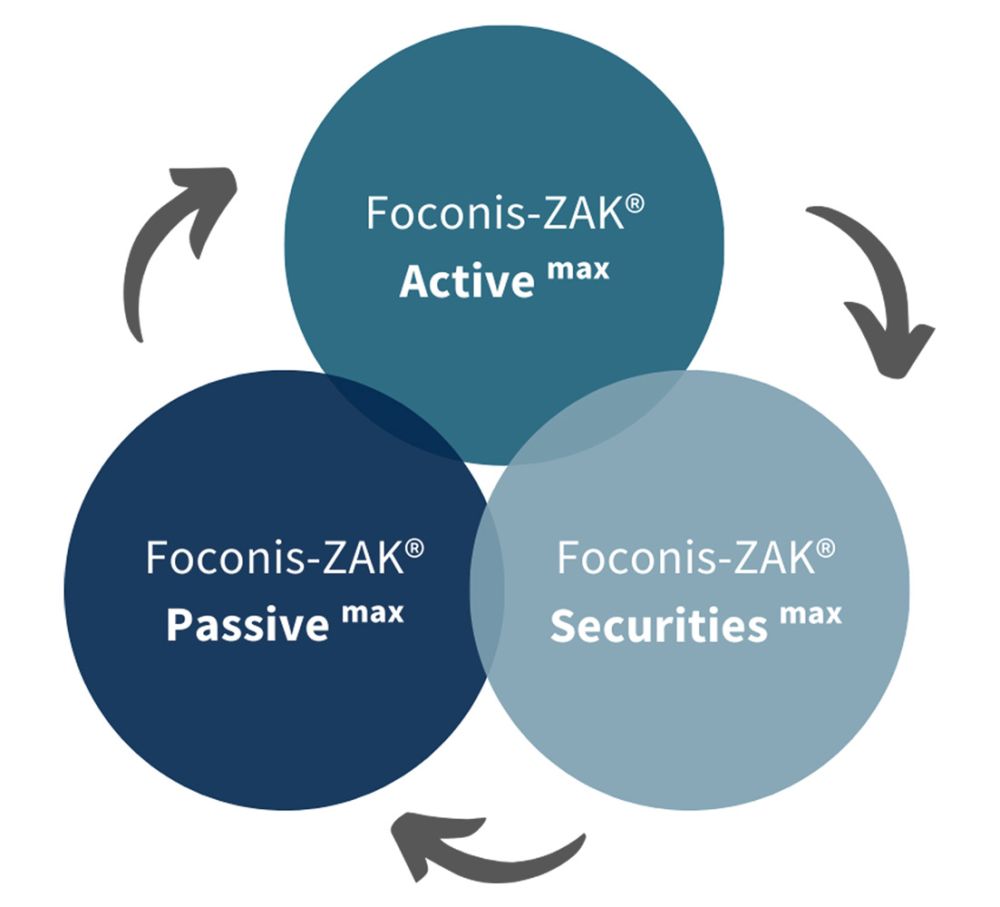

Automated and process-oriented control with Foconis-ZAK® max

The software for your internal control system

Implement regulatory capital requirements efficiently and optimize processes? Lean back and relax:

Foconis-ZAK® max provides banks and financial institutions with powerful software for their internal control system software. For you, this means more security and efficiency thanks to maximum automation, sustainable process quality, and daily updated controls.

Foconis-ZAK® max provides banks and financial institutions with powerful software for their internal control system software. For you, this means more security and efficiency thanks to maximum automation, sustainable process quality, and daily updated controls.